HOME Investment Partnership Program: 2025 Final Rule

On January 6, 2024, the Department of Housing and Urban Development (HUD) published a rule in the Federal Register: HOME Investment Partnerships Program: Program Updates and Streamlining to update, streamline, and authorize new flexibilities in the regulations governing the HOME Investment Partnerships (HOME) Program. The final rule will ease regulatory requirements and increase flexibility to support the production of affordable housing and lower housing costs while reducing regulatory burden.

In developing this final rule, HUD considered input received from a broad range of stakeholders throughout many years about the most challenging aspects of administering and using HOME funds to provide affordable housing. The proposed rule was published in the Federal Register for public comment on May 29, 2024. HUD received and carefully considered more than one hundred public comments on the proposed rule in developing the final rule.

Through this final rule, HUD seeks to reduce burden and increase flexibility for Participating Jurisdictions (PJs) and other program participants, while adhering to statutory intent and requiring responsible management of state and local HOME programs.

The final rule focuses on nine primary areas:

- Rental housing

- Tenant-based rental assistance

- Tenant protections

- Homebuyer housing

- Community Land Trusts

- Community Housing Development Organizations (CHDOs)

- Maximum per-unit subsidy limits

- Green and resilient property standards in HOME-assisted housing

- Periods of affordability

This article focuses on four of the major improvements as they relate to periods of affordability, income determinations, rents, and tenant protections.

Periods of Affordability

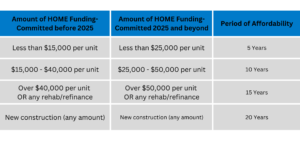

The final rule adopted updated periods of affordability to address concerns about increased development costs. The options for the period of affordability remain 5, 10, 15, or 20 years; however, the expenditure threshold to determine the period of affordability has changed.

The period of affordability begins at project completion. A Participating Jurisdiction (PJ) may implement extended commitments. However, the 2025 HOME Rule states the federal HOME requirements do not continue after the period of affordability, and any violations of the agreement after the federal period of affordability has ended would be a matter of PJ compliance, not a risk to the HOME funding. After the period of affordability, the project would be subject to the PJ’s rules but not HOME repayment.

Income Determination

The new HOME rule revised the “must” established under HOTMA to a “may,” as it relates to the Public Housing Authority (PHA) income determinations for HOME households that receive project based rental assistance (PBRA). Under HOTMA, the previous HOME rule required that the PJ “must” accept the PHA income determination for families receiving PBRA. The new HOME rule allows the PJs the choice of accepting the income determinations made by the PHA instead of requiring PJs to accept those PHA income determinations.

If a family in a HOME unit is receiving assistance from a Federal, state, or local public assistance entity (e.g., TANF, Medicaid, LIHTC, local rental subsidy programs, etc.) which examines the annual income of the HOME assisted family each year, the PJ may allow the owner/agent to accept a written statement from the assistance entity indicating the tenant’s family size and family’s annual income. This is referred to as Safe Harbor: Means-tested Income Determination. The written statement must be for an income determination made within the previous 12-month period.

For example, if the household is receiving PBRA, the PHA would provide a copy of the 50059 (completed within last 12 months) along with a written statement indicating the amount of annual income and household composition (the number of people in the family).

A PJ can implement this Safe Harbor: Means-tested Income Determination for all rental housing income determinations, including those performed at initial occupancy and every 6th year of the period of affordability. Self-certification of family income continues to be allowed for other years, although a PJ may allow the use of other means-tested income determinations for these years as well. If the PJ will allow means-tested income determinations, this will relieve the requirement of the owner agent to calculate the annual income of a family by using 2 months of source documents; this would apply if the family is receiving public assistance and the assistance entity provides a written statement indicating the annual income and household composition. Please Note: It is very important to check with your PJ to determine if they will allow the Safe Harbor: Means-Tested Income Determination.

Rents

HOME housing owners may now accept in both a Low-HOME unit and High-HOME unit with government rental assistance the rent due from the tenant (no more than 30% of the family’s monthly adjusted income or 10% of the family’s monthly income) and the subsidy payment. Prior to 2025, HOME required the tenant rent AND subsidy be added to compare to the HOME rent limits, and the only exception was Low-HOME assisted units receiving project-based rental assistance were allowed to go above the HOME rent limits (up to subsidy rental payment standard).

If a HOME-assisted unit is also a Low-Income Housing Tax Credit (LIHTC) unit and has rents no greater than the gross rent for rent-restricted residential units as determined under Internal Revenue Code Section 42(g)(2), then it shall be a Low-HOME Rent unit.

- Example: Sam moved into a floating Low-HOME unit that is also a LIHTC project with a 40-60% minimum set-aside. The Owner can charge up to the 60% LIHTC rent, and there is no conflict with the HOME program. The HOME rent rule is satisfied if the rent based on the minimum set-aside is charged.

If a tenant’s income increases above the low-income (80%) limit, the tenant must pay a rent amount equal to the lesser of the amount payable under state or local law or 30% of the family’s adjusted income. The new HOME rule clarifies that a tenant of a HOME unit subject to rent restrictions under the LIHTC program must pay a rent amount that complies with the LIHTC program.

The new HOME rule will once again allow the use of the PHA allowance, which under the previous final HOME rule was not permitted. The utility allowance for a HOME rental project can be based on the HUD Utility Schedule Model, the local PHA utility allowance, or another HUD-approved method. Note: Utilities/services excluded from utility allowance would be telephone, cable, and broadband.

Tenant Protections

The new HOME rule expands and strengthens tenant protections through a mandatory HOME lease addendum that imposes a set of uniform protections for HOME-assisted rental housing tenants. The expanded tenant protections comprise requirements in five areas:

- Physical condition of the unit and project;

- Use and occupancy of the unit and project;

- Required notice to the tenant;

- Availability of legal proceedings; and

- Protection against retaliation.

Tenancy addenda requirements will apply for all rental housing projects that the PJ committed the HOME funds for on or after February 5, 2025. Note: Written agreements cannot be revised to include the addendum or lease provisions, as these represent a significant obligation on the part of owners/agents that they must be aware of before they commit to the requirements. Therefore, these requirements cannot be made retroactively.

The HOME final rule implementation date has been postponed until April 20, 2025, but owners and agents should continue to prepare to align with the updated requirements.

The final rule will better align the HOME program with other affordable funding sources to benefit tenants and lower housing costs. The rule also streamlines and modernizes the program by easing regulatory requirements, significantly reducing the burden on owners/agents of HOME-assisted housing and the PJs.

Creating and maintaining affordable housing communities is a complex task. Numerous state and federal requirements must be followed – both during development and for years thereafter. MLCM clarifies LIHTC, Federal HOME, HUD, and certification requirements you must follow to remain compliant. For more information on these services be sure to visit our website’s services pages and don’t hesitate to contact us. The information presented in this post is intended solely for informational purposes and should not be construed as consulting advice from M&L Compliance or McKonly & Asbury, LLP.

About the Author

Susie, a veteran in her field, has over 20 years of experience in the affordable housing industry. Prior to joining MLCM she was a Senior Compliance Manager at RELATED Management Company overseeing compliance for 16,000 units spanning ov… Read more