HUD Announces Delay of HOTMA Implementation for Multifamily Housing

Updated Effective Date and Key Provisions Affected

The U.S. Department of Housing and Urban Development (HUD) has announced a delay in implementing the Housing Opportunity Through Modernization Act (HOTMA) for HUD Multifamily Housing programs. The new effective date is January 1, 2027.

HUD has confirmed that the announced delay also applies to Community Planning and Development funding (HOME). HOME was previously expected to implement as of January 1, 2026, but will now be waiting until January of 2027.

The delay affects key HOTMA provisions – primarily Sections 102 and 104 – which update income calculations, asset limits, and certification procedures for HUD Multifamily properties. The postponement is necessary to allow time for completion of essential system and policy updates, including software modifications, revised forms and model lease documents, and updates to the HUD Handbook 4350.3.

HOTMA Sections Impacted by the Delay

Section 102 – Income Reviews and Interim Recertifications

- Revises how annual and interim recertifications are conducted.

- Establishes new thresholds for mandatory interim recertifications (10% income decreases / 10% or greater rent increases).

- Modifies how assets are counted, including expanded exclusions and de minimis limits.

- Updates verification procedures and acceptable documentation standards.

Section 104 – Income Limitations for Eligibility

While the 120% over-income rule under Section 104 applies only to Public Housing, other provisions of Section 104 extend to HUD Multifamily programs. Specifically:

- Established new limits on total household net assets for HUD-assisted programs, including certain Multifamily Housing contracts.

- Defines how asset values are calculated and what types of assets must be included or excluded.

- Introduces a self-certification option for households with assets below a defined threshold (as established annually by HUD, adjusted for inflation), allowing residents to certify their assets without full third-party verification. This change is intended to reduce administrative burden and streamline processing for low-asset households.

- Allows HUD to set thresholds for disqualifying applicants or tenants who exceed established asset limits, with exemptions for retirement and education accounts.

These combined provisions represent the most substantial change to income and asset rules for HUD Multifamily programs in over a decade.

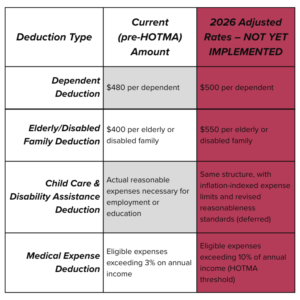

Impact on 2026 Inflation Adjustments

The postponement also delays implementation of the 2026 inflation adjustments to income deductions authorized under HOTMA Section 102(b)(2). These updates would have increased several deductions used in determining adjusted household income, but properties will continue using the current (pre-HOTMA) amounts until implementation occurs.

These increases and updated thresholds will not take effect until HOTMA is implemented. All HUD Multifamily income determinations must continue using the current deduction amounts and rules until the delayed effective date.

What Owners and Agents Should Do Now

During this extended period, HUD Multifamily owners and management agents should:

- Monitor HUD’s website for official notices, revised forms, and updated implementation materials: https://www.hud.gov.

- Consult their Contract Administrator (CA) for guidance on recertification procedures, verification requirements, and documentation standards while HOTMA remains on hold.

- Coordinate with State Housing Agencies if the property also includes Low-Income Housing Tax Credit (LIHTC) funding. Some states may delay HOTMA alignment, while others could proceed independently.

- Note that HUD has delayed HOTMA implementation for HOME-funded programs (Community Planning & Development) to match HUD’s announced delay to January 1, 2027. This was previously expected to be implemented as of January 1, 2026.

- Note that the USDA Rural Development (RD) Multifamily Housing programs have implemented HOTMA as of July 1, 2025.

Rent Override Exception

For Owners who implement HOTMA before TRACS203A is released, HUD allows use of the rent override function when the HOTMA-calculated rent differs from the pre-HOTMA rent amount. When this exception is used, Owners must:

- Complete Sections B and C of the 50059 with accurate, current household information.

- Use income, asset, and allowance data from the household’s most recent reexamination in Sections D, E, and F.

- Submit non-interim transactions as interim reexaminations when required.

HUD has advised that certain discrepancy codes may appear when rent override is used; these may be disregarded once all other information is confirmed as correct. Owners should also notify their CA when they plan to use this function and maintain clear and thorough file documentation showing:

- Which HOTMA provisions were applied,

- How income, assets, and deductions were determined, and

- The rent amounts under both pre-HOTMA and HOTMA rules.

Prepare for the New Implementation Date

Even with the extended timeline, readiness efforts should continue. Owners and compliance teams are encouraged to:

- Review HUD’s forthcoming forms, handbook revisions, and model lease updates once issued.

- Confirm that property management software can support HOTMA’s income and asset calculation changes.

- Provide refresher training for site and compliance staff.

- Maintain written documentation of all guidance and communications from HUD, CAs, and State Housing Agencies.

Bottom Line

HUD’s delay of HOTMA implementations for Multifamily Housing programs – covering Sections 102 and 104 – extends the effective date to January 1, 2027. The extension reflects the time needed to finalize critical updates to systems, forms, and policy guidance. It also postpones the 2026 inflation-adjusted deduction amounts, meaning all current deduction levels and income rules remain in effect until HOTMA takes effect.

While this provides additional preparation time, owners and agents should continue monitoring HUD communications, remain in close contact with their CAs, and maintain readiness to implement HOTMA as of January 1, 2027.

Notice H 2025-07 Issued on 12/17/2025 by HUD outlining the delay can be found here: https://www.hud.gov/sites/default/files/hudclips/documents/HSGN-07.pdf.

HUD released an online news article clarifying the inclusion of Community Planning and Development funding to the announced delay, which can be found here: CPD Guidance on HOTMA Compliance Date Extension – HUD Exchange.

For official updates and resources, visit https://www.hud.gov.

M & L Compliance Management will keep you posted on any updates as they are received.

Owners and management agents should be well trained in understanding the HOTMA requirements as they relate to maintaining compliance in affordable housing. MLCM offers consulting services and training regarding the various affordable housing programs impacted by the implementation of HOTMA. For more information on these services don’t hesitate to contact us.

The information presented in this post is intended solely for informational purposes and should not be construed as consulting advice from M&L Compliance Management, LLC.

About the Author

Becky joined MLCM in September 2025 as a Housing Compliance Consultant. She has extensive experience in the affordable housing industry, beginning her career in property management as both an on-site manager and resident services coor… Read more